«Signature of the application is not valid» error in Binance API

As you experience, one of the most common errors in the interaction with Binance API, which does not have a valid «error with» signature «. This error usually occurs due to invalid or expired signature used to autheate API applications.

In this article, we examine the possible causes behind the error and take steps to solve it using the secret key and time stamp approach.

Why update the signature?

When sending a request to Binance API, the customer (usually a program) contains a unique identifier in the authentication header. This is called «signature» or «token». The Binance API uses this signature to authenticate its requests and verify that they come from an official source.

How to update your signature:

To solve the «signature of the request», you must update the signature using the following approach:

- Get the current time stamp : Get the current Unix timer in seconds since January 1, 1970.

`Javascript

Const now = math.floor (date.now () / 1000);

- Calculate the new signature : Use the «HMAC» directory to generate a new signature using the secret key and updated time stamp.

`Javascript

Const Hmac = needed ('crypto'). Createhmac ('sha256', 'your_secret_key');

hmac.update (now.tostring ());

Const Signature = Hmac.digest ('Hex');

- Update the API request : Replace the existing «Signature» header again.

Example Code:

Here’s an example code detail to present this process:

`Javascript

Const BNB = Need ('Binance-Api');

// Set Binance API credentials and secret key

Const client = new bnb.client ({{

Apiverion: 'v2',

Accesstoken: 'Your_access_token',

});

// Get the current time stamp

Const now = math.floor (date.now () / 1000);

// Calculate the new signature

Const Hmac = needed ('crypto'). Createhmac ('sha256', process.env.secret_key);

hmac.update (now.tostring ());

Const Signature = Hmac.digest ('Hex');

// update the API request

client.authheader ({{

'Content type': 'App/json',

'Enable':beugher $ {client.getaccesstoken ()}

“Signature”: Signature,

});

The best exercises:

To avoid this error in the future:

- Use a secure and up -to -date secret key.

- Keep the secret key confidentially as it can be used to authenticate API applications.

- Refresh the secret key and time stamp to ensure continuous authentication.

By following these steps, you must be able to solve the «signature of the application is not valid» when it interacts with the Binance API. Happy coding!

Bitcoin Backward Compatibility

Market Taker, Ripple (XRP), Scalping

«SAKE SAUPER and WINS: Increase in trading of cryptocurrencies with Ripple (XRP) as your market»

In a world where trading of cryptocurrencies is more accessible than ever, it is easy to catch emotions related to the purchase and sale of digital assets at fast speeds. One of the main players who was created to help sales to scale their profits is Ripple (XRP). But what exactly means being a carrier market and how can you use Ripple as cryptocurrency for scaling?

What does it wear on the market?

The market factory is a kind of seller who buys and sells currencies or assets at the current price, without the intention of keeping it. They aim to make profits, using price movements on the market, often using technical analysis tools to identify trends and models.

Ripple (XRP) Growth as walking on the market

Ripple (XRP) has been known for a long time for its speed and efficiency in the facilitation of crossed payments. However, with the launch of the Tokena Ripple XRP, it has become an attractive option for merchants who wish to evolve the profits by creating the market and the trade.

As one of the fastest growth cryptocurrencies on the market, XRP offers traders a unique opportunity to use price movements without maintaining assets for a long time. Using the low delay of the XRP network, the market will carry out transactions with incredible speeds, often with fractions of a second between purchase orders and sales orders.

RIPPLE (XRP) scale

Scale is a high -frequency trade strategy, which includes the creation of many transactions in a short time, often using technical indicators to assess the moods of the market. Thanks to the speed and liquidity of XRP, Skalpers can quickly perform large amounts of transactions, using market variability to benefit from low price movements.

Like Ripple (XRP) SMVEPP

To evolve your profits as a Ripple candidate (XRP), follow the following steps:

- Choose the appropriate replacement : Find a scholarship that offers low shift and high liquidity for XRP, like Coinbase or Kraken.

- Define a commercial account

: Open a commercial account with a renowned broker, such as Etoro or Binance.

3 and 3

- Place large transactions : Quickly perform large transactions using the replacement and selected techniques indicators.

- Monitor market conditions : continue to monitor market conditions and adjust your strategy accordingly.

Advantages of scaling with Ripple (XRP)

The scaling on XRP offers several advantages, in particular:

* Low entry cost : By implementing small transactions, you can minimize the initial investment costs.

* High beneficiary margins : thanks to the speed and liquidity of the XRP network, you can benefit from market movements with high beneficiary margins.

* Flexibility : The scaling allows you to quickly adapt to changing market conditions, making it an ideal strategy for traders who like to be up to date.

Application

The scaling with Ripple (XRP) is a powerful tool for traders who want to use price movements on the cryptocurrency market. Thanks to its speed and liquidity, XRP offers a unique opportunity to benefit from low -prices movements without maintaining assets for a long time. Depending on the steps presented above and using technical indicators, you can become an effective rock-rock on Ripple (XRP) and add another excitation layer to your commercial experience.

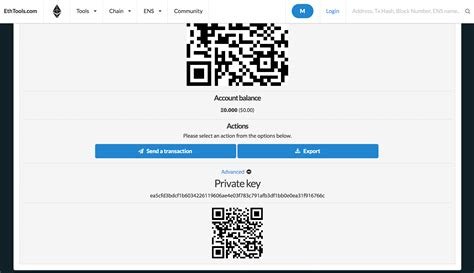

Ethereum: Transaction with highest fee, but stuck, what did I do wrong?

Early: The highest rate deal, but what was arrested?

As a user of the ethereum, you probably know the importance of the transaction and the importance of timely payment importance. However, it seems to let you think about what’s wrong because of your recent exchange. In this article, we will explore the details of the question and the possible reasons.

Question: Burke-made deal

The highest fee ($ 1.33) has been arrested but transfers are transferred. After a more detailed test, the transaction seems to interrupt due to a validation error.

According to the ethereum blockchain anaelem blockchain anaelesis tool, The Transability was tool, Block952C185264503262023D952C185264503265555570. BC24DF44F2FDD76EDDD7F43B0AB6BD5.

Why did the deal fail?

This transaction includes several reasons:

* Adequate funds :: As you mentioned, there was a relatively high rate of your transaction. However, the recipient’s wallet may not have enough funds to cover the size of the wallet.

* Incorrect Transaction Data : Double Verification reveals your transaction details or inconsistencies such as wrong values or addresses.

* Transactional Validation Questions : Erymerer validation process can be prevalent to complex and bugs. If the transaction is not valid correctly, it may have caused a trapped deal.

What to do next to the next

To solve this problem, you must do:

- Check your transaction details : Check all transactions data to ensure accuracy.

- Check the balance of the purse : Check that the recipient’s wallet has adequate funds.

- Review the Transaction Validation Errors

: See any error message or transactions for valid notifications.

By following these steps, you can solve the trapped deal and get your funds back.

ethereum blockchain info testnet wallet

Ethereum: How to use incoming Binance WebSocket data?

Using data on incoming binanth websites with Ethereum

As a developer, you may want to integrate real -time market data into your applications. One popular solution is the use of Binance Webocets API to produce incoming data in real time. In this article, we will study how to use incoming Binance web socket data to track the Ethereum prices.

Prerequisites

Before diving, make sure you have:

- Binance account and a valid API key.

Package 2 «Binance-JS» installed as an addiction: NPM install binance-js

3.

Starting with Binance Websockets API

To use Binance Websockets API, you will need:

- Create an API key on the binance site.

- Get Websochet URL following the instructions in Binance documentation.

For Ethereum prices, we will use the Eth-Apis package that provides a simple and convenient way to interact with the Ethereum blockchain site API.

Installation

Install the required packages to get started:

`Bash

NPM install binance-js eth-apis

WebSocket Connection Setup

Here is an example of how to connect to the binance webco parameter:

`JavaScript

Const {web3} = ask (‘web3’);

Const binance = ask (‘binance-js’);

Conste Apikey = ‘Your_API_KEY’;

Const Apisecret = ‘Your_api_secret’;

Conste WebsocketTl = ‘WSS: //apis.binance.com/1/webSocket’;

Const Web3 = New Web3 (New Web3.Providers.httpprovider (WebSocket));

Conste Ethapi = New binance ({

Apikey,

apisecret,

});

// Example: Ethereum Symbol Prices

Ethapi.get (‘ethusdprice’, function (error, answer) {

IF (ERR) Console.Error (ERR); // Replace with selected log message

Another {

Const price = reaction.price;

Console.log (Current ETH price: $ {price});

}

});

`

In this example, we create an example of the Eth-Apis package and come to our API key. We then connect to Binance WebSocket Endpoint using the Web3 service provider.

Incoming messages **

Incoming data are sent as messages in JSON’s format for web sockets. You will need to use a library such as JSON-Stingify-safe to parse the dissertation reports. Here is an example:

JavaScript

Const {parsemessage} = ask (‘JSON-Stingify — Dr’);

// Example: First report from binance (in this case price update)

Ethapi.get (‘ethusdprice’, function (error, answer) {

IF (ERR) Console.Error (ERR); // Replace with selected log message

Another {

Consta Data = Parsemessage (Answer);

Const {symbol, time stamp, price} = data;

Console.log (got the ETH price update on the site {Timestamp}: $$ {price});

}

});

`

In this example, we use the Parsemessage feature to Safely parsing an incoming message from Binance.

Intulation in your application

To integrate our WebSocket connection in your application you will need:

- Create a nest event for new Binance messages.

- Processing incoming messages and updating the data conformity.

Here is an example of how we can create a simple web socket server. Use the Library “WS”:

`JavaScript

Conste websocket = ask (‘WS’);

// Create a socket connection to binance webscocket endpoint

Const WSS = New WebSocket.Server ({port: 8080});

WS.ON (‘Connection’, (WS) => {

Console.log («Customer Connected …»);

// handle incoming messages from binan

ws.on (‘message’, (message) => {

Consta Data = Parsemessage (Message);

IF (Data && Data.Symbol === ‘ETH’) {

Console.log (got the ETH price update: $ {data.price});

} Else {

Console.log (ignore an unknown symbol: $ {data. Symbol});

}

});

// Close the connection when it is disconnected

WS.ON (‘Close’, () => {

Console.log (‘Customer disconnected …

Solana: Having trouble creating SPLs in local environment – both CLI & JS packages

TRUDED SLS in Solana Loca Slana *

ASA Solana Programmer, Createng SCS SLS (self-committing to proof) Ca as a terrible process. As she meets Cli and JS packages, it is created in my local environment. In this article, we will invest potential molds of problems and pass the stem to get rid of it.

Valicathor Node Starting

*

Before you dive into problems by creating Suls, let’s make our validator nodes properly. Waller knot of outpost for valid and processing training on Solan Blockchain. If you have a local instance of the Valador Node, you can check that the status is to check the fall:

- Open the ACSOLANA CLI Cadend and Naviga for you project director.

- Start Alun Catsola Conforme Get Vaalidoders, showing a list of avalidara nodes.

- Make sure one of these nodes are at least listed as active.

PO TENTENTAL PROBLEMS WITH SPS

* Creation

Assuming our Valider is running out, let’s say that her schemes are potential problems associated with creatine SLS:

- NETRISSSUSUSUES : MOS TRADE TO FAILURE Tofeken Minning in Solana Local Environys Nectifyvia Problem. Including the link on your website is stable and works properly.

- AcConcent restrictions : iPhour Acidin Limts ARET or INSCCODED or INFCIET, TRANCIGIGHT, PERJEJA FAILED. Check your balance and update necessary to avoid problems.

3.Thon Name and Symbol *: The name token and a symbol must be massaged in Botch in Botch in Cli Package (eg Tispl-Teken-Teken Crennaky (E. Solana/Spl-Oakn ‘; are ay identical.

Ttrroatusho INSTEPS PPS **

To resolve this issue, trolling:

- Check Newowork RnonecTifty : Include this is your website that is properly connected and works.

- ** K Advancement Your Account and Proposal and Manage the Signature of the Rtuding Account Restriction.

- Look a token namken and symbol : twice check that Eymbols and symbols match both in the Clipasage and JS package.

- * Insperctors’ diaries: Start the following record: This hell will be problems with ork connectric coins.

Ehamle Aves uses a case *

To illustrate this issuance, flying created the mitigation of AEXEN token and packets Cli and JS:

Nature

//createken.js

Introduce them to Frototute | Mon ‘ @Ssolana/Splu-TPOL-Tokek’;

Constable Adcount with ‘Yo Account Addres’;

Symbol Cons Sex ‘;

Creatatan (Penont, EM Syctic Symbol)

.Then ((Nin)

.Catccch (err) sy> console.error (error);

AND

UP Cloctery

Create token using a Cli package (spl-token Create-token)

SP-Texen Creen-Accoint

AND

Nature

// Createken.js (suin clin)

Introduce them to Frototute | Mon ‘ @Ssolana/Splu-TPOL-Tokek’;

Constable Adcount with ‘Yo Account Addres’;

Symbol Cons Sex ‘;

Creatatan (Penont, EM Syctic Symbol)

.Then ((Nin)

.Catccch (err) sy> console.error (error);

AND

Falling these trulung steps and checking the aforementioned potential questions, rarely solving problems in the Yurgs in the Yurgs in the Yurgs in the Yurgs at the Sen Yongs resale.

Why Confidential Blockchains Are Crucial in Today’s Cryptocurrency Market

Why confidential block circuits are very important in today’s cryptocurrency market

In a rapidly developing cryptocurrency world, safe and private operations are becoming increasingly important. With the increase in decentralized funding (Defi) and undeniable chips (NFT), the need for confidentiality and control of Blockchain technology has never been more important.

Confidential block circuits, also known as private or secret blocks, offer a level of security and anonymity that the traditional public chain cannot coincide. These private block circuits give users the ability to create and control their networks without disclosing their identity or financial information to the general public.

Why are the confidential block circuit

Confidentiality in today’s cryptocurrency market is the key to maintaining the user’s confidence and avoiding the risk of regulatory. Public chains such as Bitcoin and Ethereum are often associated with high -level burglary, theft and censorship. This has led to many consumers to look for safer alternatives where they can protect their financial information and assets.

Confidential block circuits fill in this gap, allowing developers to create decentralized networks that are independent of public blocks. Using confidential block chains, users can:

1

- Confidential block circuits provide a safer and compatible environment for companies and individuals to operate.

- Keep control over operations : using confidential blockchains, users can control the flow of funds on their networks without expecting public Biržai or centralized authorities.

Examples of convincing chain chains

Several companies have successfully created confidential blockchain networks that are growing on the market:

1

2.

- In the Market Protocol : This decentralized financial (Defi) platform is created on confidential blockchain technology that gives users more control of their assets.

Conclusion

In conclusion, confidential block circuits are extremely important in today’s cryptocurrency market, offering safety and anonymity, which cannot be coincided with by the traditional public chain. By enabling the developers to create decentralized networks without disclosing sensitive information, confidential circuit circuits provide a safer and compatible environment for companies and individuals to operate.

As the market continues to develop on the market, we can expect more companies to develop confidential Blockchain solutions that are in line with specific use and industrial branches. Whether you are an experienced investor or a beginner who wants to get involved in cryptocurrency, it is necessary to understand the importance of confidentiality in today’s rapidly developing market to understand blockchain technology.

Key Takeaways

- Confidential block circuits offer a level of security and anonymity that cannot be overlooked by the traditional public chain.

- These private networks give users the ability to protect non -disclosure data, avoid risk of regulatory and maintain surgery control.

- Companies such as Sandbox, Pillbox and Market Protocol are already successfully developing confidential Blockchain solutions that satisfy specific use and industries.

Here’s an article with some commonly used commands and a cheatsheet for Bitcoind:

Ethereum: What are some commonly used commands for Bitcoind shell command line?

As you install the Bitcoin daemon on Ubuntu, you might need to use some commands to interact with it. Here are some commonly used ones:

1. Getting Started

bitcoind --help: Displays the help menu.

bitcoind --version: Displays the version of Bitcoin.

2. Sending and Receiving Transactions

bitcoind sendfrom: Sends a transaction from the sender to the receiver.

bitcoind receivefrom: Receives a transaction from the receiver.

bitcoind getbalance: Displays the balance of your wallet.

3. Creating and Managing Wallets

bitcoind createwallet: Creates a new Bitcoin wallet.

bitcoind list wallets: Lists all wallets on the daemon.

bitcoind showwallet: Displays information about a specific wallet.

4. Monitoring and Verifying Transactions

bitcoind --blockchaindir=: Retrieves the balance of a specific address.getbalance

bitcoind --blockchaindir=: Checks if an address has any unconfirmed transactions.checkbalance

bitcoind --blockchaindir=: Lists all unconfirmed transactions.listuncommitted

5. Troubleshooting

bitcoind --debuglevel=3: Enables debugging mode and displays more detailed error messages.

bitcoind --noconsole: Disables the console output and uses a file instead.

Cheatsheet:

| Command | Description |

| — | — |

| getbalance

| checkbalance

| listuncommitted | Lists all unconfirmed transactions. |

| createwallet | Creates a new Bitcoin wallet. |

| list wallets | Lists all wallets on the daemon. |

| showwallet | Displays information about a specific wallet. |

| sendfrom | Sends a transaction from the sender to the receiver. |

| receivefrom | Receives a transaction from the receiver. |

Tips and Tricks:

- Use

bitcoind --helporman bitcoindfor detailed help messages.

- Check the Bitcoin daemon logs for error messages using

bitcoind --debuglevel=3.

- Use

bitcoind --noconsoleto disable console output and use a file instead.

I hope this helps you get started with Bitcoind on Ubuntu!

safely navigate cryptocurrency

Ethereum: Invalid public key was spent! How was this possible?

Ethereum: The invalid public key was published – how could it happen?

2023 February Consumer who had Bitcoin addresses with an invalid public key were shocked to find out that these keys were damaged and their means were given. The incident asked questions about the vulnerability of the Ethereum Smart Contract platform and how a false can lead to such a catastrophic result.

Problem: Invalid public generation

2023 February Consumer who had Bitcoin with an invalid public key 00 could not publish their coins. This error was not due to the loss of control of the user or the technical defect, but to the lack of the most important intellectual contract system from Ethereum.

According to reports, this problem was caused by an error under a certain intellectual contract, which was used at some point until 2023 on Ethereum. February including Bitcoin.

A key was vulnerable

The vulnerability was not specific for a specific user or user group. This affected all with an address that was previously issued the key «00». This means that even if the error is corrected immediately after the incident, some users are still vulnerable.

How did you publish the invalid public key?

To understand how this happened, we have to immerse ourselves in the main architecture of Ethereum. Smart contracts are self -sufficient programs that work in the blockchain network. You can follow the instructions and carry out complex logic to determine the property of the property. However, they do not require manual intervention or maintenance of a unit.

When it comes to the wrong public key problem, the problem was that the intelligent contract that created this key was based on a hard -coded card between valid public keys and its respective addresses. This enabled consumers who have an inappropriate public key without being «not transferred» without previous knowledge or control.

Riple effect

When the user tried to release his Bitcoin coins, the Ethereum system activates the approval process that checks whether the address is valid before it continues. In this case, however, the approval process failed and the wrong public key was not transferred.

This led to the Ripple effect, in which many users do not release their coins with an invalid public key and actually «spend» them without control or maintenance. The incident emphasizes the use of susceptibility to security on the Smart Contract platform from Ethereum.

Research and consequences

Ethereum has started research on this topic. Some reports indicate that developers try to correct the error and carry out additional security measures in order to avoid similar incidents in the future.

The incident also emphasizes the importance and compliance with the responsible coding practice in accordance with the coding standards. Since Ethereum develops further and grows as a platform, it is very important for developers to determine the priorities for the security and integrity of their intellectual contracts.

Diploma

The wrong public key problem emphasizes the complexity of the Ethereum -Smart Contract system and the need for constant vigilance and tests to avoid similar incidents in the future. Although this incident may have caused major disorders, it emphasizes the importance of prioritizing security and responsible coding practice.

How to Withdraw Cryptocurrency Without the Hassle

How to Withdraw Cryptocurrency Without the Hassle

With the rise of cryptocurrencies, withdrawing funds has become a crucial aspect of cryptocurrency ownership. However, many users face difficulties in this process due to various reasons such as lack of knowledge, technical issues, or limited access to withdrawal services. In this article, we will guide you through the steps to withdraw your cryptocurrency without causing any hassle.

Understanding Cryptocurrency Withdrawal Methods

Before we dive into the withdrawal process, let’s first understand how cryptocurrencies are typically withdrawn. Most major exchanges and wallets allow users to withdraw their funds in various forms such as cash, bank transfers, or other cryptocurrencies like Bitcoin Cash (BCH) or Ethereum (ETH). However, not all withdrawal methods may be available for every cryptocurrency, and some may require additional verification steps.

Types of Withdrawal Methods

There are several types of withdrawal methods you can use to transfer your cryptocurrency:

- Standard Withdrawals

: Most exchanges allow users to withdraw their funds using a standard withdrawal method such as bank transfers or wire transfers.

- Peer-to-Peer (P2P) Transactions: Some cryptocurrencies like Bitcoin, Ethereum, and Litecoin support P2P transactions, allowing users to directly transfer funds to another user’s wallet.

- Cryptocurrency Exchanges with Wallets: Many cryptocurrency exchanges offer their own wallets that allow users to withdraw their funds using various methods such as bank transfers or prepaid debit cards.

Steps to Withdraw Cryptocurrency Without Hassle

Now that you know the types of withdrawal methods available, let’s move on to the steps to withdraw your cryptocurrency without causing any hassle:

- Verify Your Account: Before attempting to withdraw your cryptocurrency, make sure your account is verified by the exchange or wallet provider.

- Check Withdrawal Limits: Confirm that there are no withdrawal limits for your cryptocurrency and that you have sufficient balance to cover the transaction cost.

- Choose a Withdrawal Method: Select the withdrawal method that suits you best, considering factors such as fees, transfer time, and recipient information.

- Provide Required Information: Provide the required information, including recipient details, address, and bank account number (if applicable).

- Initiate the Withdrawal Process: Follow the instructions provided by the exchange or wallet provider to initiate the withdrawal process.

Popular Cryptocurrency Exchanges with Wallets

Some popular cryptocurrency exchanges with wallets that offer easy and convenient withdrawals include:

- Binance: Binance offers a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Its user-friendly interface makes it easy to withdraw funds using bank transfers or prepaid debit cards.

- Kraken: Kraken is another popular exchange with a vast selection of cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH). Its wallet support includes P2P transactions for users who want to directly transfer funds to their wallets.

- Coinbase

: Coinbase is a well-known cryptocurrency exchange that offers easy and secure withdrawals using bank transfers or wire transfers.

Tips and Best Practices

To avoid any hassle when withdrawing your cryptocurrency, follow these tips and best practices:

- Make sure you have sufficient balance: Ensure that you have enough cryptocurrency in your account to cover the withdrawal amount.

- Verify your identity: Complete the verification process to comply with anti-money laundering (AML) regulations.

The Hash-Rate Conundrum: Unpacking the Relationship between Difficulty and the Maximum Target

Ethereum’s hash-rate has long been a topic of interest among miners and enthusiasts alike. As the total hash-rate of the Bitcoin network rises, it may seem counterintuitive that the difficulty target decreases to increase the computational power required to validate transactions and create new blocks.

At its core, the relationship between hash-rate and difficulty is based on the underlying mechanics of blockchain networks. Let’s delve into the specifics of how it works.

The Difficulty Formula

The difficulty target is determined using a formula that takes into account several factors:

- The current hash-rate of the Bitcoin network

- The number of minutes since the last time the difficulty was increased

- The number of confirmations required for a new block to be added to the blockchain

This formula can be expressed as: difficulty = (hash-rate * 2^32) / (time since last increase).

How Hash-Rate Affects Difficulty

As the hash-rate increases, the difficulty target also rises. This is because more powerful computers are required to solve the complex mathematical puzzles that need to be solved in each block. Specifically:

- More powerful GPUs and ASICs can perform calculations at a faster rate

- The larger the hash-rate, the greater the number of possible solutions for each puzzle

The Hash-Rate Threshold

According to the Bitcoin protocol, the maximum difficulty target is a 256-bit number (32^8). This threshold is used to ensure that the network remains scalable and prevents it from becoming too computationally expensive.

Why Does the Difficulty Target Decrease as Hash-Rate Increases?

As more hash-rate is added to the equation, the difficulty target decreases. This may seem counterintuitive at first, but it’s essential to understand the underlying mechanics of the formula:

- More hash-rate increases the number of possible solutions for each puzzle

- As the network becomes increasingly difficult, it takes more time and computational power to solve each puzzle

In other words, as the difficulty target rises, more powerful miners are incentivized to participate in the network by offering higher block rewards. This drives up the overall hash-rate, making the difficulty target decrease.

Conclusion

The relationship between hash-rate and difficulty is a complex one, but it’s essential to understand how the two factors interact. As the total hash-rate of the Bitcoin network rises, the difficulty target decreases, ensuring that the network remains scalable and secure. This dynamic balance between hash-rate and difficulty ensures that Ethereum and other blockchain networks remain competitive and viable.

Additional Resources

For more information on the Bitcoin protocol, please visit:

- For a detailed explanation of the difficulty formula, please consult the original source article from Bitcointalk:

- To learn more about Ethereum’s hash-rate and block reward system, visit: