HD wallet keys to the structure of trees: proven exercises

Ethereum deterministic hierarchical wallets (HD) offer a safe method for storing and treating private keys. A critical aspect of security maintenance is the protection of the underlying private keys, especially in the structure of the HD portfolio tree. In this article, we explore the best practices to use hardened keys in an HD wallet.

Understand the hardened keys

The hardened keys are encrypted versions of the usual private keys Ethereum. Unlike the regular keys that an intruder can easily regain decryptrapography without a key, the hardened keys require a strong and separate key to open. This is especially important in the wood structure of the HD wallet, where several children’s keys show a longer key key.

General guidelines for trained keys

If you build the structure of an HD portfolio tree with trained keys, consider the following recommended exercises:

1.

- Children’s keys vs. Parental Keys : Usually the child’s key should only be hardened if absolutely necessary (for example, for administrative or control purposes). The keys to parents who point to the children’s keys can usually remain intact.

3.

* Master Extended Key: This is usually the highest key on your wallet and this must always be confirmed.

* Children’s keys: These are the children’s keys that point to the extended master key.

* Alchand Keys: These are even more specific children’s keys within a single child key.

- Avoid the keys to the hardened parents : As mentioned earlier, parents’ keys usually do not have to stay bad.

More considerations

HD wallet with keys trained when constructing wood structure:

- Regular maintenance : Review keys regularly to ensure that they remain safe with time.

- Rotation of Key : Rotate keys regularly (for example, every 12 months) to minimize the effects of your keys to your commitment or loss.

- Backup and Recovery

: Make sure you have a reliable backup plan, including a secondary storage method for your HD wallet.

Conclusion

Proper implementation of hardened keys in the structure of the HD portfolio tree is essential to maintain the safety and integrity of private Ethereum keys. By following the recommended exercises, you can ensure that the keys are protected and difficult to endanger. Keep in mind that you always have a priority for the main maintenance and backup procedures to minimize possible risks.

Example of case use:

Suppose you have an HD wallet with a longer key. There are also children’s keys that point to this extended mainstream. The following structure would be appropriate:

`

Long -lasting Master key (trained)

/ \

Child1

/ \

Child2

`

In this example, all children’s keys harden (that is, their own keys are encrypted and protected), while the extended master key remains illegal.

By following these recommended guidelines and exercises, you can effectively protect private Ethereum keys within the HD portfolio structure.

Wallet address, Pre-Sale, Polygon (POL)

«Crypto’s Rise to Hunger With Polygon: The Story Behind with a successful success»

In recent times, cryptocurrencies have gained enormous popularity between investors and enthusiasts. One of the pioneers in this space is Polygon (previously known as Matic), a decentralized platform that has made waves since its beginning. In this article, we will deepen the world of Crypto, Wallet addresses, pre-sales and the story behind Polygon’s success.

What is encryption?

Crypto, an abbreviation of cryptocurrency, is a digital or virtual currency that uses encryption for security and is decentralized, which means that it is not controlled by any government or financial institution. It was created to provide an alternative to traditional Fiat currencies, offering faster, cheaper and safer transactions.

TRAPFORS addresses

A portfolio address is the unique identifier of the cryptocurrency account of a user on a specific blockchain network. Each wallet address has a corresponding public key that can be used to send and receive cryptocurrencies. To use these addresses, you need to install a digital wallet on your device or software application that supports the specified blockchain.

pre-sale

A pre-sale is an exclusive sale of cryptocurrency token for a group of Early Adopter before they become available to the public. This event offers investors a unique opportunity to buy in the project at a discounted price, which can increase its value and potentially lead to significant yields on investments.

Polygon (pol)

Polygon is a level 2 reduction solution that allows faster transactions processing times keeping low taxes. It was founded in 2017 by Anthony Di Iorio and Charles Hoskinson, two prominent figures in the cryptocurrency space. In 2020, Polygon completed his pre-sale for his native token, Matic (previously known as Matic).

During the pre-sale, investors had the opportunity to purchase a part of the total supply of token pol at a discounted price. This event generated a significant interest between cryptocurrency enthusiasts and institutional investors.

Polygon’s success story

Since its institution, Polygon has recorded rapid growth, with her native native token that has obtained significant value gains. The success of the platform can be attributed to several factors:

- Scalability

: Polygon is designed to resize the Ethereum network, which was previously struggling to develop high volumes of transactions.

- Low commissions : Polygon offers low transaction commissions compared to other level 2 downsizing solutions on the Ethereum blockchain.

- Fast transaction times : Polygon technology allows quick and efficient transactions, making it an interesting option for both companies and people.

Conclusion

Polygon (Pol) is a pioneering project that has made great strides in the world of cryptocurrency. From his humble beginnings to his current success, Polygon has shown exceptional growth and scalability skills. With its unique solution for the downsizing of layer 2, low taxes and fast transaction times, the polygon is well positioned for long -term success.

Whether you are an adopting first or an expert investor, Polygon offers an exciting opportunity to be part of the cryptocurrency revolution. While we continue to explore new technologies and innovations in the cryptocurrency space, Polygon is likely to remain at the forefront of rapidly evolving in this landscape.

The Role of AI in Preventing Cryptocurrency Scams

The role of ai in the prevention of cryptocurrency scams

The increase in cryptocurrency has brought with it a new wave of scams that go to individuals and businesses equally. With the growing popularity of digital currencies, scammers have found creative ways to deceive and disappoint unsuspension users. Artificial Intelligence (AI) HAS Become a Crucial Tool to Combat Thesis Scams, Offering a Variety of Benefits and Characteristics That Make It An Essential Component of Cryptocurrency Safety.

The Problem: Cryptocurrency Scams

Cryptocurrency scams can Take Many Forms, Including Phishing, Malware Attacks, Bomb Schemes and Diver and Ponzi Schemes. These scams are of Based on Social Engineering Tactics, Using False Characters, Convincing Messages and Manipulated Images To Attract Victims to Invest or Negotiate Cryptocurrencies with False Promises of Unusually High Yields.

The Role of Ai

Artificial Intelligence Has Several Key Roles to Perform to Prevent Cryptocurrency Scams:

- Predictive Analysis : AI Systems can Analyze Large Amounts of Data from Various Sources, Including Social Networks, Online Forums and Market Trends. This allows them to identify Possible patterns of scammer Behavior, Such as Suspicious Keywords or Phrases Used in False Messages.

- Patterns Recognition : AI Algorithms can Recognize complex patterns in financial transactions, which can indicate a scam. When Analyzing these patterns, The Systems Propelled by Ai Can Mark a Suspicious Activity that Guarantees Greater Research.

- Automated Detection : IA -Based Tools Can Scan and Analyze Large Data Sets, Detecting Possible Red Flags, Such As Unusual Transaction Patterns, Wallet Addresses with High Volatity or Repeated Attempts.

- Risk Assessment : Risk Assessment Platforms Based on ai can Evalability the Probability of a scam Based on Factors Such as the reputation of the scammer, wallet history and other relevant data points.

Solutions with ai

Several Companies and Organizations Have Developed Solutions with Ai Specifically Designed to Combat Cryptocurrency Scams:

- The smart contract of coincheck : This intelligent contract, builds with blockchain technology, uses ai to detect and prevention phishing attacks by identifying keywords and suspicious phrases.

- blockchain analysis of the chain : chainysis sacrifices a blockchain analysis platform that uses automatic learning algorithms to identify and mark malicious activities in the block chain.

- ** Ciphertrace Money Laundering System (AML): Ciphertrace Provides an Aml System That Uses Ai Motor Analysis to Dect and Prevent Cryptocurrency Transactions Related to Money Laundering and Other Illicit Activities.

Benefits or ai to prevent cryptocurrency scams

The Implementation of AI in the Safety of Cryptocurrencies Has Numerous Benefits, which include:

- Improved Detection Rates

: AI Systems Can Identify Potential Scams at a Higher Rate Than Human Analysts, Reducing the Risk of False Positives.

- Improved Risk Management

: AI -Based Platforms Can Evalability of A Scam and Alert Users to Take Preventive Measures, Such As Freezing Wallets or Informing Suspicious Activities.

- Greater Efficiency : Tools Based on -Automatic Many Tasks, Releasing Time for A More Critical Analysis and Decision Making.

- Better Customer Protection : AI Systems Can Provide Personalized Protection Against Scams Through the Analysis of Individual User Data and Wallet Data.

Conclusion

The Emergence of Cryptocurrency has created a new panorama for scams to operate. However, the integration of ai in the prevention of cryptocurrency scams sacrifices a powerful tool for people and companies that see to protect their financial assets.

Solana: How to allow browser wallet sign umi transactions?

I can provide you with an item based on your request.

Authorize UMI Transactions for Solana Browser Partfolio

As a developer using the Metaplex platform to create and manage NFT, it is essential to understand how to interact with the Solana blockchain. One of the main characteristics of Metaplex is its ability to support browser portfolios, which allow users to sign transactions without having to use a physical device or account on a decentralized application chain (DAPP).

In this article, we will focus on activating UMI transactions of wallet portfolio on Solana using JavaScript. We will also cover all the errors that can arise and provide advice on how to help them out.

Prerequisite

Before diving into the code, make sure you have:

- A metaplex account with a functional DAPP chain

- A Solana knot installed on your local machine (or connected to a remote node)

- A JavaScript environment configured to compile and execute our code

The code

Here is an example of how to create an NFT token using a UMI transaction browser portfolio sign:

`Javascript

Const {web3} = require ('web3');

Const {deploy, signed} = require ('@ metaplex / fabric');

Const web3 = New Web3 (New Web3.Providers.httpprovider ('

// Define NFT metadata

Const nftmetadata = {

ID: '0x ...',

Name: "My super nft",

Description: "A digital active ingredient",

Image: '

};

// Create a new mint for our NFT token

asynchronous function create () {

Const Mintid = Waits Deploy ('Mint', Web3, NftMetadata);

console.log (mint created with id $ {MINTIDE});

}

// Define the address of our browser portfolio

Const Browserwalletaddress = '0x ...';

// Works to sign UMI transactions using a browser portfolio

Signnumint asynchronous function () {

Const Signature = Await Deploy ('signnumi', web3, nftmetadata);

Console.log (UMI transaction signed with ID {signature.id});

}

// Main execution flow

Createmint ();

Signmint ();

// Error management: if you encounter problems during the creation of mint or sign UMI transactions,

// This will be saved to the console.

Console.error ('Error Creation of the UMI transaction of mint or signature:');

'

Troubleshooting

If you feel errors while trying to create a mint or sign a UMI transaction, make sure:

You have installed the required outbuildings (@ metaplex / manufacturers and ‘web3) in your JavaScript environment.

Your Solana node is properly configured to provide the necessary RPC termination point (https: // api.solana.com / rpc).

- The address of the browser portfolio you have specified is correct and corresponds to the address of your Metaplex account.

Current errors

Here are some current errors that can occur when creating mint or UMI transactions:

* Error Sign the transaction UMI

: this error generally occurs when the "Deploy" function does not create the UMI signature. Check out thesigned function output» for all journalization instructions related to this problem.

* Error Creation of Mint : If you encounter a problem during the creation of mint, make sure that the address of your browser portfolio is correct and corresponds to the address of your Metaplex account.

By following these guidelines and for troubleshooting advice, you should be able to create and sign UMI transactions using your Solana browser portfolio.

Metamask: How can I switch to address in list connected address in metamask?

Here is a step -by -step guide to switch from one account to another in metamask, especially for connecting the address list:

Switching to account b (or any other connected account)

And seamlessly switch between them. Metamas with each Connected accounts.

1. Add All Accounts

First, make sure that all accounts are connected and checked in your metamk safe. «Add»

Switching Between Accounts

- Open Metamk

– Run Metamas on any device.

–

- Connect the Account

– Click the «Account List» button in the Upper Right Corner of Metamass. This opens the drop -down list with all your connected wallets.

- Select an account b

– Find the account you want to switch to (in this case, account b). Select it from the drop -down list.

- Switch to account a or b

– To move back to account a or save the current connection to one of the other accounts, click

- POP -UP Sign Report (Optional)

If a pop –up sign appears after shifting the accounts, it usually indicates the transaction information and asks if you want to sign the message. You can choose:

– Yes: Sign the Message.

– No: don’t sign the message.

– later: choose this option later during your session.

Important notes

– Each connected account is checked separately before switching.

– Changing accounts do not affect the remaining or transaction history of metamask.

– You can switch accounts at any time when performing these steps.

Make sure all accounts are synchronized and updated before

This guide should help you navigate multiple accounts in metamask. If you have problems during the switching process or have additional questions about metamk features, be sure to ask!

Bitcoin: bitcoin rpc: bitcoin-cli positive fee

Understanding Bitcoin Inputs and Rewards «Bitcoin-Clli»

As a Cryptocurrency initiator or enthusiast, you are probably heard of various commands available through the «Bitcoin-Clli» interface that interacts with the Bitcoin network. One of the most interesting features of the Bitcoin-Clve is its ability to use RPC (remote process call) to use and manipulate the blockchain below.

In this article, we deepen the two special topics related to the "Bitcoin-Clli" use: using events such asListatraSactionsand GetraSacttion ‘, and by studying the effects of the positive payment of these events.

Bitcoin-RPC commands

The Bitcoin-RPCinterface allows you to use different aspects of blockchain data, including events. The most commonly used commands are:

ListtraSactions: List all in your wallet all unused transaction sources (UTXOS).

Gettransaction: Applys for one event with his or her ID.

Payment and Positive Payments

We are now dealing with the positive rewards of Bitcoin events.

Bitcoin has a feature called "soft-fes" or "variable-fee", which allows miners to set their own payments for events. This means that instead of applying a fixed fee per syllable (known as a basic fee), miners can choose how much they want to charge based on the complexity and size of the event.

When you use theBitcoin-Clvei commands such as the ListtraSactions," getransaction "or other RPC commands, you will actually apply for information about the block chain without paying any charges. This is because these events are not sent to the peer network (another network node), but rather retrieved directly from Blockchain itself.

Can the rewards ever be positive?

In theory, it is possible that the rewards are positive in Bitcoin. However, this requires you to retrieve information from a source other than the main block chain, such as a minister or a node on a separate network.

For example, if you use "Bitcoin-Clli" to pick up certain events and then send it back to another node, the receiving node may possibly charge a positive payment for processing the event. This would require you to process payment transactions between nodes in this way.

conclusion

In summary, while payments are typically used to send Bitcoin events to another knot or mining work, there is no natural reason why they cannot be applied when using RPC commands, such as "Listatransa and Getransaction". However, retrieving information from Blockchain without paying is a different story. If you are going to process payment transactions between nodes in the future, you must be aware that fees may become a problem.

Example of use cases

Let's look at how these RPC commands can be used with positive payments, some of the examples:

ListatraSactionsandGetraSaction ‘to apply for a specific event:

`Bash

Bitcoin -Cli -ListtraSactions -txid

Bitcoin -Cli -GettraSaction -txid

`

- Sending a payment transaction between two nodes in different networks using the

Bitcoin -RPCinterface:

`Bash

Node 1 (a) – send payment to the knot b (b)

Curl -x mail \

\

-H ‘Content-Type: Application/JSON’ \

-D ‘{«txid»: «123456789», «From»: «A», «»: «B»}’

Node B receives payment and updates the balance

`

Understanding how the `Bitcoin-Clve works with RPC commands, you can better understand the complexities of Bitcoin events and network interaction. However, always be aware of the fees when dealing with payment transactions between nodes in the future.

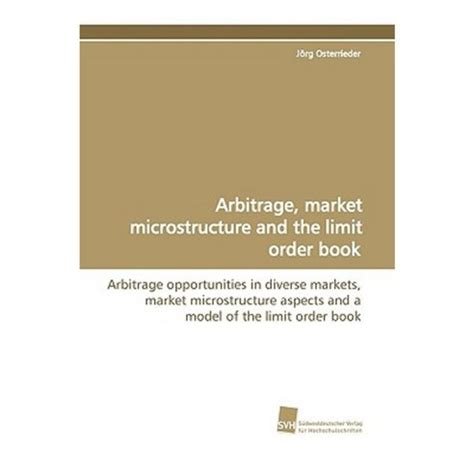

Order Book, Arbitrage, Price Volatility

Mastering of the art of trade in order books, arbitrage and price volatility

Trading is a complex and high endeavor created by Varius Dinamics. In this article we will deal with trade: order books, arbitrage and price volatility.

Order books: The basis of market efficiency

An order book represents the current status of Amarket, with and sells orders side by side. It is essentially a snapshot of all available offers and offrs for everyone. A well -organized order book offers insights insights, Helten Traders itterifies trends, pauters and trade optimities.

Order books are built on several key principles:

– slip.

- Visibility : A clear and user-friendly orders of the book offers dealers all access to all available orders to deactivate the make-grounded Deco.

- Real -time data : Order order books of real time so that dealers can react to the same way.

Arbitrage: The key to the success of trading

Arbitrage are the processes that take advantage of the differences in prime to various markings with regard to orexchanges to profits. Due to the simultaneous identification and closure of shops in several markets, arbitrageurs can consider considerable professionals. Arbitrage about the same prices for equality of the nominal signs that dealers benefit of capitalization.

Arbitrage strategies:

- Market depth

: Identifying markets with deep liquidity and enables dealers to enable life each.

- Price differences : Determination of the discrepancies between different markets, it is profit for profit.

- Risk management : Implementation of the rice reduction measures, Souch as stopless and posts of ssing, to minimize losses.

Price volatility: The elephant in the room

The price volatility refers to the fluctuations over time over time. Market participants can volatility through to and scrapsed to high or reversed. The price volatility results from different factors, including:

- Market feelings : Changes in the trust of the market and the hiring of investors can have an impact.

- Economic indicators : Economic data releases, Souch as a GDP growth rates, inflation or interest rates can affect the markings.

- Event-oriented trade : Messages events, winning reports and external brand-murerununions Cannunununene.

Strategies for the championship price volatility

To effectively navigate the volatility:

- DIVESIFATE Your trades : Spread your RSK for various markets and strategies to minimize the losses.

- Stay up to date : continuous monitoring of market news, economic data and feelings to expect potential.

- Use stop-loss orders : Reface the price warnings and limit your exposure to avoid losses in the case.

Diploma*

Order books, arbitrage and volatility are fundamental concepts in the trade that can help the dealers to promote well -founded decisions and markings. If you understand this prime gate, you will be better equipped to navigate think about staying vigilant, adapting to changing -related conditions and constantly reducing your strategies to optimize your strategies.

Additional resources

- Online courses: [Traders Edge] ( or [Stockmarketwarrior] (

- Commercial communities: [Reddit’s R/Trading] (https: //www.reddit.

Ethereum Name Service Market Maker

Ethereum: Is there an efficient way to exploit arbitrages between the different exchanges?

Ethereum: Reviewing effective arbitration opportunities between exchanges

The Ethereum network, like its predecessor Bitcoin, relies on price irregularities between different cryptocurrencies. These price differences can be used by traders who want to use the market inefficiency. However, the existence of a reliable and effective way to use such arbitration opportunities is the topic of the ongoing debate.

Basics of Arbitration

Arbitration occurs when there is a price difference between two or more markets with minimal fees or no commission. This difference allows traders to benefit from the purchase of low and high sale, as long as market conditions remain favorable. In the context of cryptocurrency exchange, arbitration can be facilitated by using differences in price strategies between different platforms.

The unique features of Ethereum

As a decentralized platform, Ethereum has several features that facilitate arbitration:

1.

- High -speed trading

: Ethereum is designed to handle the high volumes of transactions per second, making it the main goal for accelerating strategies.

- Low slip : The low slip -off nature of the Ethereum network allows traders to maintain a strict range between prices.

Current arbitration opportunities

Although there are opportunities for arbitration in various cryptomains, including ethereum, they come with significant risks. Some popular options include:

1.

$ 2.

- ETH-TRON (Arbitration Crores-Bchain) : This platform offers replacement of the truss chain for trading with Ethereum (ETH) against TRON (TRX).

However, it is important to note that these arbitration opportunities may have high minimum requirements or complex fees that can limit access.

Fears and scalability

The effectiveness of the strategy arbitration depends on the ability to maintain a strict span between prices as well as minimizing commercial costs. While the features of the Crosserum chain of Ethereum and the low slip makes it a major goal to accelerate strategies, these benefits may not be universally applicable in all cryptomains.

Efficiency is also closely associated with scalability concerns. As the demand for crypto -transactions increases, the number of miners who are trying to confirm transactions to public blockchains such as bitcoin is also increasing. This can lead to increased fees and lower profit margins for traders who rely on Ethereum or other decentralized platforms.

Conclusion

Although arbitration occasions are available in Ethereum, they often require effectively implementing significant sources and expertise. As the demand for cryptoms continues to grow, there will be competition between exchanges that are trying to use irregularities in prices. However, in careful analysis of market conditions and strategic implementation, it is possible to create effective arbitration strategies that can help traders benefit from these opportunities.

Important note : Always do thorough research and proper care before being involved in any business strategy, including those that include arbitration in different cryptoms.

Ethereum: How many Namecoins are generated per block? [closed]

I can provide you with information about Ethereum and Namecoin.

Ethereum Namecoin Block Award for Prize

Ethereum’s Namecoin (ETN) has a unique feature: there is no block of stop rewards as well as other crypto currencies. The block award is generated by transaction fees for each block collected by miners.

The block award is currently set to 50,000 etc. However, as time goes on and the number of transactions increases, the block of rewards is reduced over time to encourage miners to confirm more transactions in less time.

NameCoin block schedule of halting

Namecoin also does not follow the arrangement of halves such as bitcoin or other crypto currencies that have been longer. The reason is because of the basic blockchain structure and mechanism of consensus.

Namecoin’s consensitive algorithm is based on the proof of space (POS), which means that each block contains a list of 64 randomly selected blocks from the previous block, not minerals that confirm transactions as in POW system such as Bitcoin or Ethereum Classic.

There is currently no scheduled halting for Namecoin. The decision to halve or not, she is left to the Namecoin community and her consensitive algorithm developers.

How much didcoin is generated by block?

The NameCoin Block Award was quite low, which means that more coins were mined than the others because of a larger number of transactions that are processed by each block. This has increased the miner award, but has also limited new coins production compared to other crypto currency with lower rewards blocks such as Bitcoin or Ethereum.

Conclusion

Ethereum and namecoin do not follow the traditional halter schedule, which can lead to problems with their usefulness over time as the block reward decreases. However, this structure allows them to be more stable than some other crypto currency, which may have experienced rapid fluctuations of prices due to blocked awards.

Ethereum: Why do you need the *complete* blockchain to mine bitcoins, why not just the last n blocks?

Importance of full Bitcoin mining and fork is the importance of a resolution

As the largest cryptocurrency of the market, the Bitcoin has faced many challenges over the years, including security threats, scaling problems and regulatory control. The essence of these concerns is Blockchain technology, which is based on the Bitcoin network. One of the most significant advantages of all Blockchain’s use is its ability to provide a safe and decentralized mechanism to solve potential fighting or blockchain differences.

Why a fork resolution is a complex problem

When it comes to solving forks that occur when two different versions of Blockchain are different from the main circuit, miner plays a crucial role. Mountains compete to find the longest valid bag that has not been done before. However, this process requires access to the entire blockchain, including all previous blocks (i.e. all Blockchain). The problem arises because forks can occur at any time, and mining should be able to check the validity of the blocks on both sides of the fork.

All the benefits of Blockchain usage

Using the full Blockchain, Bitcoin Mining offers several benefits:

- Security

: With access to all previous blocks, the mining can ensure that their bags have not been executed before, reducing the risk of being caught in the fork.

2.

- Improved security measures : Having access to all previous blocks can implement advanced security measures such as zero knowledge evidence to avoid attacks as 51%.

Why not just use the last N blocks?

While it may seem attractive to simply use the last N blocks (eg 100 blocks) mining and fork resolution, this approach has several drawbacks:

1

- Decentralized mining restriction : Based on a smaller block size (eg 100 blocks), mining can be limited to their ability to check and confirm blocks, which can lead to slower treatment time and reduce mining efficiency.

- Scaling disadvantage : The use of a smaller block size can limit the scaling of the network, making it less suitable for large -scale applications or high -flow systems.

Conclusion

In conclusion, the use of Bitcoin’s extraction and fork resolution must be used with the entire Blockchain. This allows the Mountains to reach all previous blocks, ensure security, decentralization and improved security measures. While using a smaller block size (eg 100 blocks) may seem attractive, it is a major risk for network safety and scaling. Following the full attitude of Blockchain, developers can ensure that their cryptocurrency remains safe and resistant to emerging challenges.

Links:

- All Bitcoin Circuit – Coindesk

- «Sakiai resolution Bitcoin Network Bitcointalk

- The Importance of Full Bitcoin mining and fork resolution «