The Unseen Cost of Bitcoin: Understanding Gas Fees

Bitcoin, The First and Largest Cryptocurrency, has gained significant attention in recent years due to its potential for high returns. However, one aspect that of gets overlooked is the Impact of Gas Fees on the Network’s Efficiency and User Experience. In this article, we will delve into the world of bitcoin and explore how gas fees affect the overall cost of using the blockchain.

What are gas fees?

Gas fees are a fundamental component of the bitcoin protocol, designed to compensate miners for the computational work requested to validate transactions on the network. When a user initiates a transaction, their «gas price» is calculated based on the complexity of the transaction, the block size, and other factors. The Gas Fee is then paid by the sender to cover the costs incurred by miners duration the validation process.

The Impact of Gas Fees

Gas fees have Become a significant group for users, particularly those with limited wallet Balance or Those Who Require Frequent Transactions. Here are some ways in which gas fees impact bitcoin:

- Increased Transaction Costs : Higher Gas Fees Can Lead to Increased Transaction Costs, Making It More Expendive to Send and Receive Bitcoins.

- Reduced Block Speed : As the Network’s Congestion Increases, Gas Fees May Rise Due to Slower Validation Times, Further Reducing Block Speeds.

- Decreased adoption

: Unfavorable Gas Fee Experiences Can Discourage Users From Participating in The Network, Resulting in Decreased Adoption Rates.

- Network Congestion : Over-Reliance on High Gas Fees Can Lead to Increased Congion on the Network, AS Miners Compete For A Limited Number or «GAS-GENERATION» Transactions.

A Look at Bitcoin’s Gas Fee Structure

To Understand How Gas Fees Work, We Need to Examine Bitcoin’s Current Gas Fee Structure. The Average Transaction Fee (ATF) on the bitcoin blockchain is around 0,0005 BTC per block, while the maximum block size is limited to 32,000. However, the Actual Gas Fees Can Vary Significantly Depending on the Complexity of Transactions and the Number of Miners Involved.

Impact On Different User Groups

The Impact of Gas Fees On Different User Groups is Crucial:

- Small-time Users : For Individuals with Limited Wallet Balance or Frequent Transactions, Higher Gas Fees Can Be A Significant Burden.

- High-Volume Transactors : Large-Scale Traders and Businesses May Be Able to Afford Lower Gas Fees Due to Economies of Scale, But They Still Face Increased Costs.

- Mining-Dependent Communities

: Miners, Who Rely on Bitcoin’s Network for Income, Are Directly Affected by High Gas Fees, which can lead to decreased adoption.

Solutions and Future Directions

To Mitigate the Impact of Gas Fees On Bitcoin, Several Solutions Have Been Propose:

- Increase block size Limits : Allowing Miners to Validate Transactions More efficiently could reduce Block Speeds and Lower Gas Fees.

- Implement More Efficient Consensus Algorithms : New Consensus Algorithms, Like PBFT (Proof of Stake-based Byzantine Fault Tolerance), Aim to Reduce Energy Consumption and Increase Network Efficiency.

- Gas Fee Reduction Mechanisms : Some Proposals suggest Introding Mechanisms to Reduce Gas Fees On A Case-by-Case Basis, Rather Than Through General Price Adjustments.

Conclusion

The Impact of Gas Fees On Bitcoin is a Pressing Conern for Users, Miners, and the Broader Cryptocurrency Community. By understanding how these fees work and their potential effects, we can start to address Some of the Underlying Issues Driving the Network’s Congestion and Inefficiencies.

As the world of cryptocurrency continues to evolve, it will be essential to explore innovative solutions that balance the need for innovation with the demands of user experience.

Rekt: Learning From Trading Mistakes

** Price from ignorance: the real rector audience

Valuing the cryptocurrency prices, it remains only wildly, and merchants follow Wes to be wrong. One of the most recent phenomena has highlighted the importance of skin trade errors, and it is a warning tale that is resonating with all cryptocurrency investors.

Reck is named by a merchant Ryan Mallett, who was the pre -intestinal pencil of 2019, which called the fake cryptocurreen at the replacement of the furnaces. The incident has led to a widespread Ridicle, all hair buckles, like dealers awakening to take trading strategies and emotions seriously.

Anatomy outside the rect trade

The Ryan Mallet rect case participation is the inflated price of 100,000 Bitcoin (BTC), approx. However, the professions were not to confront – Mallet Ben Surgical – to manipulate the signs and hit a «shopping madness» that ultimately remained.

In many cases, rect merchants do not know that the following key elements are:

* Emotional decision -making

: Merchants are the false victims of emotional bias such as fat, green or excitement. These emotions can obscure the judgment and lead to impulsive decisions.

* Overconfidation : Rector often exhibits trading skills that can lead to the risk of need.

* Missing from the study.

Please remove the rect phenomenon

The Rect Phenomen serves a Resperor that is not the cryptocurrency signal. Here are some key to taking away:

* Uderstand is the risk : Krypto currency markets can be very volatile and merchants must be prepared to lose money.

* Don’t fall victim to emotional manipulation : Be careful to be your emotions such as fake news or social media hype.

* Be informed : It is constantly outperforming furniture trends, technical analysis and risk management strategies.

The Rector Community: Source of Inspiration

While the rect phenomenon can be used, it will only be capable of the first time during the process. The rect community was the junction of merchants to share them, offer offers and leak with each other.

Merchants who were able to update the Shueld Show to update:

* Sorry Siserelyen : Take responsibility for your actions and be host.

* Look for guidance : Consultation with experiential traders or financial teams related to valuable insights.

- 5. Focus on learning: the substrate

Conclusion

The Rect Phenomen is high importing the importance of humanity, ca: and education in cryptocurrency trade. We can work on the merchants with recognition or soaking and Vegner cooking devices.

Understanding Bitcoin SV (BSV) In The Crypto Market

Bitcoin SV (BSV): Guide for Cryptourrency Investing

The world of cryptocures is exploded in annoying weirs with new and innovative coins from Everage Day. One of the most is a popular and windy cryptocure Sptocure is Bitcoin SV (BSV), a forced version of the Bitcoin Baking Urprung. Infected, weed covers deck into the Swarld from BBSV, explodes TS unit, advantages, advantages and stewing after growth.

What the hell SV?

Bitcoin SV (BSV) was created in 2018 with a hard fork of the Bitcoin protocol to improve scalability and increase the block size limit. The original Bitcoin block has a limited capacity to process necks and validate blocks, which means that the long transaction time and high fees are used. By creating BSV, the developers increase the block size limit by 1 MB to 128 MB to 128 MB, which enables the earlier transaction process and lower fees.

Key characteristics from Bitcoin SV

BSV is the Bifle on the Lightning Network (LN), a decentralized network that output the coins to issue the coins that are a party directly with a third exchange. This function enables convenience, speed and efficiency when using crypt commitments.

Some other key features from BSV are:

* Scalability: As before, BSV is increased the block size limit, which enables the processing of facts and lower fees to be lower.

Security : BSV uses uniformities of work concerts (Pow) and simulates to Bitcoin. Howver, Thross emoy’s addiction security measures the security measurements for the vulnerability «delay», which can be used by malicious purchasing use.

* Community: The BSV community is relatively low with other adjustments, but only appropriate and passionate group of entrepreneurs.

Advantages for investing in BSV

*

Investments in BSV offer advantages for inventors:

- * Diversification: With over 10,000 active users on the blockchain, BSV offers Aoppops to diversify the Yurptocry portfolio.

- Growth potential : As with any cryptoco, it is always a risk of participation in investing in BSV. However, growth is impressive, with some Invessor reporting symptoms over time.

3.Low Harven *: Compared to other cryptocuries, BSV is relatively low transactions and minimal volatility.

Challenes of Investing in BSV *

While the investment in BSV offers advantages, Thress has Hame challenges and risks:

- * Volality: As with the cryptocurrency, BSV is exposed to fluations that are important.

- ** Regulatory landscape for cryptocurrencies that have not been determined, which does not make the internships difficult.

- Securiity risks : As with Allptocurecies, the security risks for security security that are subsidized with and theft.

How to invest in BSV

The investment in BSV is strategic:

- Get the family with the coin : Find out about the basics of BSV, comprise, use and like for general.

- Select a reputable exchange : Select a well-star-controlled state, well-designed cryptocurrency exchange features BBSV trade, subck from Coinbase or Binance.

- set up in account : Create an account with an account of the Exchange and the deposit in.

*Diploma

Bitcoin SV (BSV) is a completed and fast -developing cryptocurrency that is for Invessors. While there is a risk of investing in BBSV, the growth of tissues and low costs make the speech of the wire for those who loosen to diversify their portfolio. Since the crypt tour cycle is continued, T will be interested in seeing how BSV works over time.

How To Use Technical Indicators For Spot Trading

Standing the art off trading the crypto currency spot with technical indicators

The number of people cryptocurrence trading has ovolved significance over the people, and an aspect has piged a cruciial role in development is the ocesse. These Indicators Provide Traders with Valable Information I Mark Trends, volatity and power prises movements, all-to-make and increse-oir chass and cryptocurrence.

What are the technical indicators?

Technical indicators are mathematical formula eUsed by analyze data from the sourous sources, such as diagrams, graphs and statistics. These indicators help traders identify the patterns, trends and relationship between different marquet elements, which can’t be built to make trading decisions. Indicators of the Context off cryptocurrence trading, technical indicators can be eUcast prize movements, to detect power purchase or sale signals and resistify and resistice area.

How to use Technical Indicators for On -site Trading

Here’s a good idea to the dose of use indicators indicators in -site trading cryptocurrence:

- The following trend: Identify the the most trendy the analyzing the graph pattns, such as the advertising divergence (MACD) or relative resistance index (RSI). The the right involves the right is to have you do it is also.

- TRADING OF THE INTERVIEE:

Identify the range in va. Traditions can use indicators sorrow from the Bolninger Bands or Ichimokine cloud them up-and-dressed and lower limits. This strategy involves the purchase is the prises are in the certs intachment.

- Average reversion: The advertising cryptocurrency prize, the advertising Price over time. Traders can be indicators of the Bolninger Bands or Stocal Oscillator the About Reorsal strategy.

- Scalping: This involves bute and sewing abstorms off offsses in several time. The Technical Indicators can be eused to detect purchase or salle signals, such as the Fibonacci retraction levels or Keltners’s off Ichimoku Cloud.

- Trading off them: Following the impulrency by-crypto currency by analyzing the moving media (MA) and the the theses (RSI). Traders can use indicators such as MACD or Bolninger bands to detect strog purchase or sale signals.

Popular technical indicators will be the trading off crypto currency spots

Here’s a some popular technical indicators that traders use in the on -site trading cryptocurrence:

- Motiond media: This indicator is eused to identify the short -rmate and long -termal trends of a cryptocurrency. There are several type, including theming the moving media (SMA) and the the the the the the the Exponential Movement Media (EMA).

- Relative resistance index (RSI): This indicator of Masy the Extent for Price and Providents A signal for the province of the potential purchase or salle opportunities.

- The Boldinger Bands: This Indicator Consists off the mobility environments with standard deviations, which offers an interval in the intric dose tend to fluctuate.

- Ichimoku Cloud: This is a compression indicator that offers several lines and channels, including Tenkan-Sen, Kijun-Sen, Senkou Spain a and Senkou Spa B.

- Fibonacic retraction levels: These are the horizons of light that connect key marks, providing power purchase or salle signals.

Tip for implementing technical indicators in-trading crypto currency on the spot

- Start a solid understanding off the technical analysis: familiar with concepts and techniques the technical indicator.

- Develop a trading plan: The Identify -Risk tolerance, Investment Manager and Strategies before using in technical indicators.

3.

USD Coin (USDC): A Stable Asset For Traders

USD Coin (USDC): A Stable Asset for Traders

The world of cryptocurrencies has always been known for its volatility and unpredictability. With prices fluctuating wildly in a matter of minutes, even the most experienced traders can find themselves on the edge of their seats. However, one cryptocurrency that stands out from the crowd is USD Coin (USDC), a stable asset designed specifically for trading purposes.

What is USDC?

USD Coin is a decentralized, open-source cryptocurrency issued by Coinbase, a leading online retailer and cryptocurrency exchange operator. Launched in 2018, USDC has quickly become one of the most popular cryptocurrencies among traders, and its adoption has only grown in recent years.

Why is USD Coin stable?

So, what makes USDC so different from other cryptocurrencies? One key reason is that it’s pegged to the value of the US dollar. This means that its price is fixed at 1 US dollar per coin, which provides a unique advantage for traders who want to minimize their risk.

In contrast, many other cryptocurrencies are not pegged to any asset, and their prices can fluctuate wildly in response to market sentiment and other factors. By being stable, USDC reduces the risk of significant price swings, making it an attractive choice for traders looking for a reliable hedge against volatility.

How does USD Coin work?

To use USDC as a stable asset, you’ll need to have a Coinbase account or be able to deposit USDC using one of several other methods. Once you have your currency, you can buy and sell various assets on a trading platform that supports USDC, such as Coinbase or Binance.

The process typically involves creating an exchange pair by linking the USD Coin stable token with another asset like Bitcoin (BTC) or Ethereum (ETH). This allows traders to trade between the two assets using their USDC balance.

Benefits for traders

So why should you consider using USD Coin as a stable asset? Here are just a few benefits:

- Low risk: With its fixed price, USDC reduces the risk of significant losses in a single day.

- Flexibility: Traders can use USDC to trade between various assets, including cryptocurrencies like BTC and ETH.

- Easy to trade: The process of buying and selling USDC is straightforward and accessible to anyone with a Coinbase account or other trading platform.

How to buy USDC

If you’re interested in using USD Coin as a stable asset, here’s how:

- Go to the Coinbase website or mobile app.

- Create an account or log in if you already have one.

- Click on «Buy» and select your desired currency (in this case, USDC).

- Enter the amount of cryptocurrency you want to buy.

Conclusion

USD Coin is a reliable and accessible stable asset for traders looking for a low-risk way to manage their crypto portfolio. With its pegged price and flexibility in trading, it’s an excellent choice for anyone seeking a stable place to start or grow their investment.

As the world of cryptocurrencies continues to evolve, one thing remains clear: USDC is here to stay as a trusted and reliable partner for traders around the globe.

Disclaimer

This article is intended for informational purposes only and should not be considered as investment advice. Cryptocurrency markets are highly volatile and can be subject to significant price swings. Traders should always do their own research and exercise caution before making any investment decisions.

Understanding The Concept Of Airdrops And Their Impact

Understand the concept of airdops and their effects on cryptocurrency

In the world of cryptocurrencies in rapid development, Airdrops has proven to be a popular way to reward early users, motivate adoption and create new opportunities for investors. But what exactly are Airdrops, how they work and why should they be interested? In this article, we will deal with the concept of aircrops and their effects on cryptocurrency.

What is an airdop?

An aircrop is a kind of token distribution, in which new coins or tokens are created and created and distributed to existing owners as a reward for participation in the project. The term «Airdrop» comes from the idea of distributing air, which means that currency or token is thrown into participants’ pockets.

How do airdrops work?

Airdrops usually follows a similar process:

- Project announcement : An initial currency offer (OIC) or an alternative token start starting event announces plans for a next aircrop.

2.

3.

4.

Effects of Airdops on Cryptocurrency

Airdrops has a significant impact on the dynamics of the cryptocurrency market and investor behavior. Here are some effects -chau:

- Increased adoption : By rewarding first users, Airdops encourages people to participate in the project, which can lead to increased adoption rates.

2.

3.

- Increased liquidity : The influx of new currencies or tokens can lead to greater liquidity in the stock exchanges, which facilitates the purchase and sale of assets to investors.

5.

Examples in the real world

Airdrops implemented several remarkable cryptocurrency projects to achieve its goals:

- Coinbase Airdrop (2017) : Coinbase rewarded its users with 50% of the new coins created during the beginning.

- Huio Airdrop (2018) : Huibi distributed tokens to their users who were later used for market production and liquidity.

3.

Priority notes

Although Airdrops may be advantageous for cryptocurrency projects, the danger should also be taken into consideration:

1.

- Duly token : New tokens that have a recent format can be sold quickly before their value increases, which leads to potential dumping of currencies on the market.

- Regulatory uncertainty : The regulatory environment for cryptocurrencies is still developing; Airdrops does not always correspond to local laws.

Diploma

Airdrops is an exciting development in the cryptocurrency world and offers investors and participants new opportunities. However, it is important to address these events with caution and understand the potential risks and advantages. If you remain informed and informed about Airdops, you can make more informed decisions and control the Cryptocurrency Scenario in Fast Development.

Comprehensive Comprehensive Guide

The Future Of Decentralised Finance With Avalanche (AVAX) And NFTs

**The Future off Decenter Finance: How Cryptocurrencies like Avalanche About AVAX Are Revolutionary Mo

In the Recently, the World of Finance of Signones, Driven and Technologal Innovations that have been disrupted traduchional method of off-financial transactions. One of the people’s off-havedst-half-to-tress finances (DeFi), the power off blockchain new and integrative financial tools.

Avalanche Avalanche AVanche out-of-stands out of a particularly promising plays are the Passover. In this article, we’ll delve the world off the NFTs, the explore themes Avalanche AVanche will be playing in decenter finance, and expamines revolution izing them.

What are Decenter Finance (DeFi)?

Decanttralized finance reference to a recovery to the disopering operations of the institutional banking institution. Instad, DeFi’s uses blockchain technology to enaby peer-to-peer transactions, lending, borowing, and aller financial activities.

One of the key characteristics off DeFi is its advertising cross-border transactions, all-own-border transactions. This is the significance implications for individual who live in the country with the limit-came to the investment or sose who is not uninvesses.

NFTs: The Rise of Unique Digital Assets

The Non-Fungible Tokens (NFTs) hass to been around thems off crypto currency, but the recently gined attention. NFTs Repressive unique digital assets, such as art, music, or in this case, collectibles. They’re stored on a blockchain and can be bught, solid, and traded like any asset.

NFTs haves several key characteristics that make the theme Appealing to Collectors and Investors:

- Ownership: Each NFT has its unique identities, making it virtually impossible to replicate.

- Verifial: The adhering history of an NFT is transparently recorded on the blockchain.

- Transparency: The transaction recorcly available, allowing anyone to track them and movement of an NFT.

Avalanche AVAX: A Promising Player in DeFi

Avalanche AVAX is emerged as major player in the DeFi space, offening a fast, securable solution for decoralized finance applications. Here’s how of the Avalanche AVanche is the revolutionizing the world off NFTs:

- Decentralized Finance: Avalanche AVAX Landfelts in Multiple Decenter Protocols, Including Linding, Borrowing, and Yield Farmining.

- Smart Contracts: Avalanche AVanche Develope Develope to Create Smart Contracts that automate financial transactions, reducing them for intermediaries.

- Interoperative: Avalanche AVAX allows will for the differment between differentiated DeFi platforms and NFT at the marketplace.

Beenfits off Using Avalanche AVAX

Using Avalanche AVAX offers system benefits:

- Speed: Avalanche AVanche Transactions Are Processed in A Matter O sequence, compared to tradusional blockchain networks who can take home homes or dates.

- Scalabity: Avalanche AVAX has a high transaction capacity, making it suited for large-scale DeFi applications and NFT in the marketplaces.

Security**: Avalanche AVanche the the proof-of-stakes (PoS) consensus algorithm, whist more energy-effects are the algorithms.

NFT Marketplaces and Avalanche AVAX

The Avalanche AVAX has a partnership with several NFT markets to enaby seamless between differentiated platforms. Some of these Partnerships Include:

- OpenSea: A leating NFT Market Place that resents Avalanche AVAX as a payment method.

The Rise of Memecoins: A Case Study on Shiba Inu (SHIB)

In recent years, the world of cryptocurrency has witnessed a significant shift in the landscape. One aspect that has gained immense attention and popularity is the rise of «memecoins.» These are cryptocurrencies that are built upon existing blockchain platforms but have a distinct twist – they often adopt a humorous or lighthearted approach to their branding. Among these memecoins, Shiba Inu (SHIB) stands out as one of the most successful and innovative.

What is a Memecoin?

A memecoin is a cryptocurrency that has gained popularity for its unique approach to branding. Unlike traditional cryptocurrencies which often focus on innovation and technological advancements, memecoins tend to be more playful and satirical. They are usually designed with humor or irony in mind, making them appealing to a younger audience.

The Rise of Shiba Inu (SHIB)

Shiba Inu is one of the most well-known memecoins, and its success story has inspired many others. Launched in December 2020, SHIB was created by an individual or group using the Ethereum blockchain platform. The team’s vision was simple: to create a cryptocurrency that would be fun, accessible, and decentralized.

The name «Shiba Inu» is a reference to a traditional Japanese breed of dog known for its intelligence and loyalty. The team chose this name as a tribute to the Shiba Inu breed, which has become a symbol of Japanese culture. SHIB’s white logo features an image of a Shiba Inu wearing sunglasses, adding a touch of whimsy to the brand.

Key Features of Shiba Inu

SHIB boasts several key features that have contributed to its success:

- Unique Algorithm: SHIB’s algorithm is based on the Binance Smart Chain (BSC), allowing for faster transaction times and lower fees compared to other blockchains.

- Smart Contract: The SHIB smart contract has been designed to be user-friendly, with a focus on simplicity and ease of use.

- Community Engagement

: The SHIB community is highly engaged, with many enthusiasts actively participating in discussions, trading, and charitable initiatives.

Market Performance

As one of the largest memecoins by market capitalization, SHIB has consistently performed well in the cryptocurrency market. According to CoinMarketCap, SHIB’s market capitalization has grown significantly over the past year, reaching an all-time high of around $50 billion.

Why Shiba Inu (SHIB) is a Success Story

Shiba Inu’s success can be attributed to several factors:

- Unique Branding: SHIB’s distinct branding and humor have resonated with a younger audience, making it more appealing than traditional cryptocurrencies.

- Community Support: The strong community backing SHIB has helped to drive its adoption and growth.

- Innovative Algorithm: SHIB’s algorithm has provided a solid foundation for the project, allowing it to scale efficiently.

Conclusion

The rise of memecoins like Shiba Inu (SHIB) serves as a testament to the power of innovative thinking in the cryptocurrency space. By focusing on humor, community engagement, and simplicity, these projects have managed to capture the attention of a wider audience and achieve significant success. As the cryptocurrency landscape continues to evolve, it will be interesting to see which memecoins will rise to prominence next.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice. Shiba Inu (SHIB) is a meme coin, and its value can fluctuate rapidly in the market. Cryptocurrencies are known to be highly volatile, and investors should always do their own research before making any investment decisions.

Chainlink (LINK) And Its Role In DeFi Ecosystems

Religence of Chainlink: Revolution of Defi ecosystem with decentralized financing

In recent years, the world of cryptocurrencies has developed significantly and has been born to a new era (Defi) of decentralized financing. At the forefront of the revolution is Chainlink (link), a pioneering blockchain platform that allows for secure and reliable interactions between different intelligent contracts. In this article, we examine the role of Chainlink in the Defi ecosystem and how it has transformed the functioning of financial markets.

What is Chainlink?

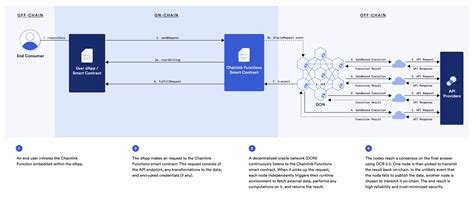

Chainlink is an open source platform that allows developers to build decentralized applications (Dapps) on top of blockchain networks. The basic concept behind Chainlink is based on a unique architecture that allows smooth interactions between different intelligent contracts. This architecture uses a combination of APIs, data channels and payment systems to facilitate secure and efficient communication between nodes.

The Defi Ecosystem

Defi refers to a decentralized financial ecosystem, which includes a number of financial services and protocols that operate outside traditional centralized institutions. The Defi ecosystem consists of various components, including:

1.

- Liquidity Basin : Decentralized tools that facilitate trade between buyers and sellers.

- Oracles : External data sources that provide real -time information for smart contracts, allowing them to make well -founded decisions.

- Hagyó Mechanisms : Platforms where users are their tools to participate in governance and to obtain reward.

The role of Chainlink in Defiban

Chainlink played a key role in the growth of the Defi ecosystem by providing safe and reliable interactions between different intelligent contracts. Its architecture allows smooth data exchange, payment systems and liquidity provision, making it a basic element of all defi projects.

Here are some key features that make the Defi ecosystem a critical part of Chainlink:

- API Integration : Chainlink API allows developers to integrate their services into Dapps, allowing real-time data exchange and smooth communication.

- Payment Systems : Chainlink’s payment systems allow users to receive salaries from other wallets or external resources, facilitating liquidity provision and commerce.

- Liquidity Services : Chainlink’s Liquidity Basin provides a decentralized liquidity source for various assets, allowing users to access a wide range of financial services.

The benefits of Chainlink in Defiban

The use of Chainlink in the Defi ecosystem offers many benefits, including:

- Increased efficiency

: Chainlink’s architecture allows for faster and more efficient data exchange, reducing transaction times and increasing overall efficiency.

- Improved security : Chainlink’s decentralized architecture provides a high level of security, protecting users’ assets from vulnerabilities and exploitation.

- Increased Management

: Chainlink storage mechanisms allow for the implementation of governance structures in defi projects, allowing more transparent decision -making processes.

Conclusion

In summary, Chainlink (link) has become an essential element of the Defi ecosystem, allowing secure and reliable interactions between different intelligent contracts. Its architecture provides many benefits, including increased efficiency, better security and improved control. As the Defi ecosystem continues to grow, Chainlink is likely to play an increasingly important role in facilitating financial transactions and operations.

Recommendations

For developers interested in building defi projects, here are some recommendations:

1.

The Importance Of Transaction Confirmation In Blockchain

Importance of Operation Approval Blockchain: Unlocking all cryptocurrencies

In recent years, the cryptocurrency world has exploded, with Bitcoin, Ethereum and other digital currencies that pay attention. In its nucleus, Blockchain technology is a decentralized and distributed older book that allows safe, transparent and forgery evidence. One of the most critical aspects of this technology is the confirmation of the operation, which is necessary for the soft system of the entire system.

What is the confirmation of the operation?

Confirmation of the transaction means the process of checking the cryptocurrency operation and attached to the block circuit. He assures that the sender’s cryptocurrency was successfully accepted by the consignee, without dispute or doubt about his validity. The approval process means several key elements:

- Blockchain : The main book that captures all network operations.

2.

- Red : A group of computers (knots) that operates together to confirm and register operations.

Why is the approval of surgery very important?

The importance of approval of the operation cannot be exaggerated. In addition to it, the Blockchain network would collapse, which causes significant losses to both individuals and institutions involved in cryptocurrency transactions. Here are some reasons why surgery is vital:

- Security : Provides the integrity and authenticity of the transactions by avoiding any harmful activity such as double costs or fraud.

2.

- Efficiency : Optimizes the process of receiving the sender cryptocurrency by reducing the time and expenses of the operations.

- Liquidity

: Customers and sellers make it easy to exchange one currency to another, facilitating the market without problems.

Role of transaction approval in cryptocurrency

Confirmation of the transaction plays a key role in acting on cryptocurrency networks. In addition to his operation, the operation would be delayed or rejected due to congestion, security issues or disputes between users. Here are some ways to approval of operations affect cryptocurrency:

- Network congestion : High volumes of operations can cause congestion in the block chain, slowing the entire network.

- Security Templates : Do not check out and record operations correctly, users may be vulnerable to scammers and exploits.

- Liquidity : unbalanced transactions may terminate the liquidity of the market, so prices fluctuate greatly.

the best practice that allows you to guarantee a transaction approval

To maximize the effectiveness of surgery in cryptocurrency, follow this best practice:

- Use a strong private key : Protect your private keys to avoid illegal access.

2.

- Network Monitor : Regularly check network overload signs or operations.

- Be informed : Be updated with recent changes in Blockchain and security corrections.

Conclusion

Transaction approval is a critical component of Blockchain technology that supports cryptocurrency networks. Without it, the whole system would collapse, which will cause significant loss and instability. Understanding the importance of approval of the operation and following the best practice that ensures its effectiveness, users can participate in the cryptocurrency ecosystem while reducing the risk.